October 29, 2019 -- Associate Professor Ding Haoyuan was awarded 2018 "Pushan academic research award" for the published paper "connect to trade" in Journal of international economics.

A key foundation of Chinese style institutions is that governments at different levels control resources and utilize their power to support businesses connected to them. We examine how this institutional feature affects firm exports. We first provide a simple model to demonstrate the underlying mechanisms. In our model, politically connected firms gain a comparative advantage in contract-intensive and financially-dependent sectors. But political connections also have an adverse effect on firm exports because of managerial inefficiency. The overall effect is thus ambiguous and differs across sectors. Employing merged Chinese listed manufacturing firm data and Chinese custom data for the years 2004–2013, we find robust evidence consistent with our model's predictions.

01

The mystery of the industry structure of China's export growth

Recent studies in the trade literature identify domestic institutions as an important determinant of a country's comparative advantage (e.g., Berkowitz et al., 2006Ju and Wei, 2010Levchenko, 2007Manova, 2013Nunn, 2007Nunn and Trefler, 2013). Ju and Wei (2011) further argue that this point is particularly true for economies with low-quality institutions, where institutional factors can be more important than factor endowment in determining their comparative advantage.

At first glance, it seems difficult to reconcile this argument with the experience of China, the largest export economy in the world. The quality of China's judicial and financial institutions is rather poor according to standard measures. For example, Kaufmann et al.'s (2003) rule of law index, a commonly used measure of judicial quality, ranks China's quality as 120th in the world in 2014. China's financial institutions are also known to be underdeveloped. For instance, China has below average scores and ranks lower than other emerging countries, such as Pakistan and South Africa, in both legal creditor rights and shareholder rights (e.g., La Porta et al., 1998, 1999).

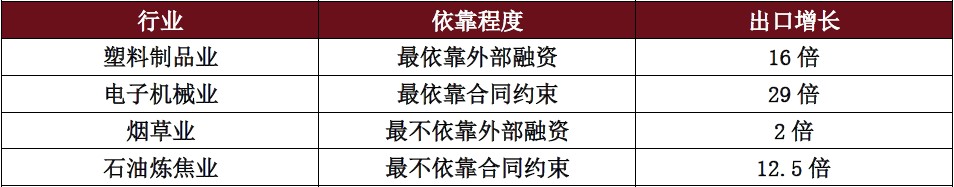

Table 1 industry export growth in 2000-2013

02

Informal Institution

This study aims to contribute to the literature by exploring the trade effects of a new form of informal institution that is of particular importance to China. A key foundation of Chinese-style institutions is that governments at different levels control allocations of resources and utilize their political and economic power to support businesses.

03

How informal institutions affect export: a simple model

In order to study how informal institutions affect the export of enterprises, the author first constructs a simple heterogeneous enterprise model, which aims to explain its potential impact mechanism and provide testable hypotheses for empirical analysis. In the model, some enterprises' material input is relationship specific. Due to technical reasons, its proportion varies among different industries. Departments with a higher proportion are more dependent on the degree of contract execution (Levchenko, 2007). In addition, in order to produce and enter the foreign market, enterprises need to borrow funds to pay a certain proportion of the cost. This proportion reflects the dependence of enterprises on external financing, which is subject to technical factors and has differences among industries. Based on the empirical findings of the existing relevant literature (charmilind et al., 2006; Claessens et al., 2008; Faccio, 2006; Fraser et al., 2006; Johnson et al., 2002; Khwaja and Mian, 2005; Li et al., 2008; Sapienza, 2004), as an enterprise under the formal system, it has two key advantages compared with the enterprise under the Informal Institution, i.e. relatively perfect contract legal environment and developed External financing channels. Therefore, enterprises under the formal system have comparative advantages in contract intensive and external financing dependent industries.

However, enterprises under the formal system also have disadvantages, i.e. lower management efficiency (such as Chaney et al., 2011; Claessens et al., 2008; fan et al., 2007; Leuz and Oberholzer Gee, 2006). According to the latest research findings (Bloom et al., 2016), management efficiency will play an important role in the export of enterprises. Based on this finding, the author hypothesizes in the model that when management efficiency is low, the marginal production cost of enterprises increases with the increase of informal institutional relevance. This negative impact related to management efficiency is pervasive and does not change with industry changes. Therefore, the overall impact of the system on the export performance of enterprises (including export revenue, export quantity and variety quantity) is uncertain, which depends on the degree of dependence of enterprises on external financing or contract execution.

04

Empirical result

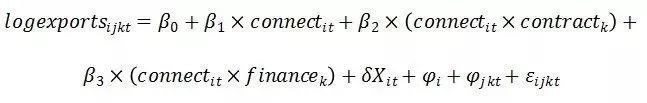

To empirically examine the effects of political connections on firm exports, we estimate the following benchmark specification:

Where logexports ijkt represents firm i's log export value to destination country j in sector k in year t. Connect it is a measure of firm i's political connectedness. Contract k and finance k are measures of dependence on contract enforcement and external finance at the sector level, respectively. X it is a set of firm-level control variables including total factor productivity (TFP), return on assets (ROA), leverage, log total assets, and log number of employees. 8 X it also contains firm tax burden and domestic-sales-to-total-sales ratio to account for the impacts of taxes and domestic market on firm exports. To further separate the effects of political connections from those of other corporate governance variables, board size, board independence, and board leadership (Chief Executive Officer [CEO]-chairman duality) are included in X it as well. Firm fixed effects, φ i , and destination-sector-year fixed effects, φ jkt , are also added to control for unobserved firm heterogeneity and country-sector level demand shifts.

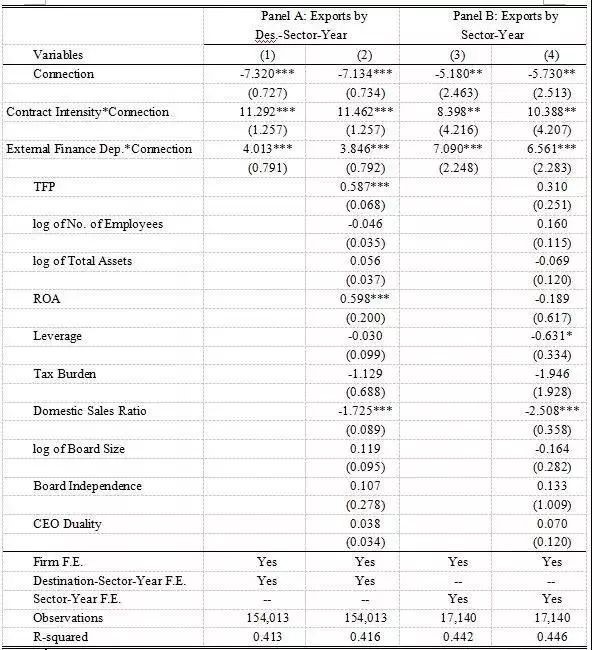

We then conduct more rigorous regression analysis and report our benchmark regression results in Table 2. Panel A shows the estimation results of Eq. (19) using firm-destination-sector-year data.

(1) does not include firm-level control variables, whereas Column

(2) contains the full set of controls. The benchmark regression results are in favor of our hypotheses. The estimated coefficient on political connections per se is negative and significant at the 1% level, but those on the two interaction terms are positive and significant at the 1% level, meaning that political connections have a general negative effect.

Table 2 Regression Analysis between the degree of political connection, contract restriction and external financial dependence and the export of enterprises

Note: all regressions contain constant terms. (1) And (2) controlling firm and destination country industry year fixed effect, (3) and (4) controlling firm and industry year fixed effect. In brackets are robust standard errors, (1) and (2) using destination industry year clustering robust standard errors, (3) and (4) clustering to industry year level. *, *, and * * are significant at the significance levels of 10%, 5%, and 1%, respectively.

In addition, the paper also finds that the informal system has a significantly stronger impact on private enterprises through contract implementation and external financing channels; including export revenue, the informal system has a similar impact on the number of exports and export varieties.

Source: h. Ding, H. fan, and S. Lin, "connect to trade", Journal of international economics, 110, 50-62, 2018

Bio of Author

Ding Haoyuan, associate professor, doctoral supervisor and the assistant dean in charge of internationalization of COB, SUFE. He received his Ph.D. in economics from Chinese University of Hong Kong, ‘Shanghai Chenguang scholar’ awarded. His main research fields are corporate finance, international finance and China's economy. In the past four years, his 11 publications have appeared on top international journals such as journal of international economics, Journal of comparative economics, Journal of international money and finance. He is undertaking NSFC project and three ministry (provincial) projects.